FuW’s fifth Insurance Broker Forum in Rüschlikon confirmed that the insurance world is on the brink of profound change. Between regulatory pressure, digital progress, artificial intelligence and growing skepticism towards traditional remuneration models, the brokerage industry must reinvent itself. The future belongs to those who create transparency, digitize processes intelligently and become visible.

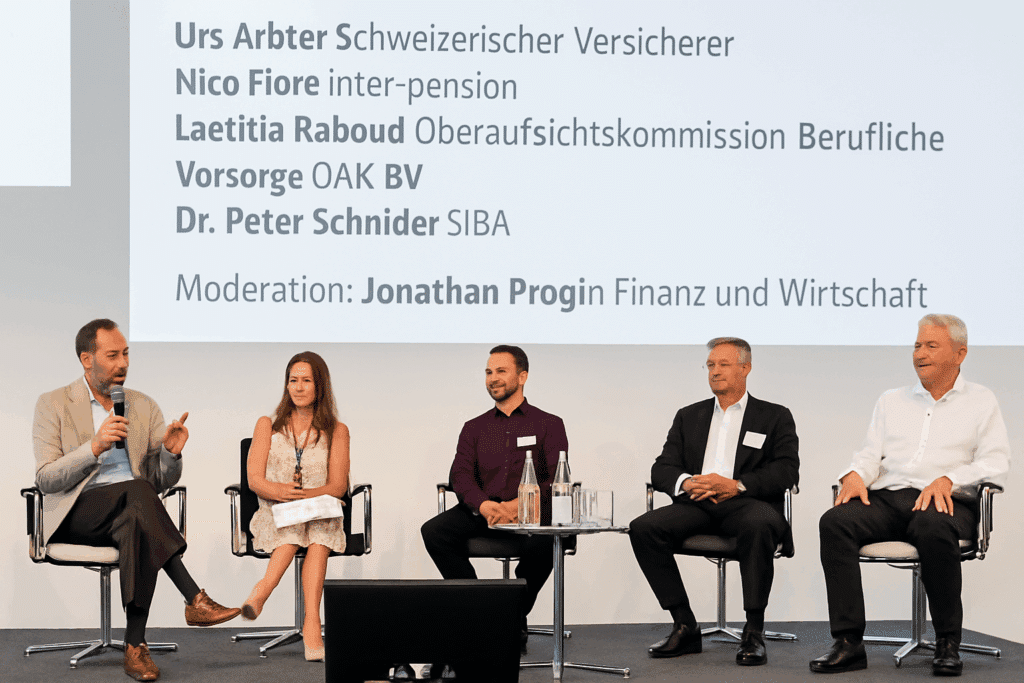

Few topics are currently causing as much controversy in the industry as the discussion surrounding brokerage fees. Their critics describe the commission model as non-transparent and systemically unfair because it is often not clear who pays and for what. Many brokers, on the other hand, defend brokerage fees as a practical model, especially for smaller companies. International experience shows this: Where brokerage fees have been banned, as in England or the Netherlands, the density of advice has fallen massively. SMEs in particular were often unable to afford fee models. The Swiss market seems to be more aware of its reality: detailed billing and disclosure of remuneration create trust. And that is needed more than ever.

Digitalization: from process to process chain

Data is also seen as a new raw material in the insurance industry. But digitalization does not simply mean scanning PDFs or using chatbots. It requires structured, standardized processes. Platforms like EcoHub are leading the way: Without media disruptions, they enable the end-to-end processing of quotes, policies, premium invoices and brokerage fees, across company boundaries. But the industry is still digitally sluggish. The technology exists, but it needs to be implemented consistently. If you don’t want to miss the boat, you have to think about processes holistically as a chain and not as individual components.

Artificial intelligence: detective in the system

AI is not only helping to formulate emails, it is increasingly becoming a tool against insurance fraud. In fraud prevention, algorithms are now able to recognize complex patterns in accident reports or claims. If four vehicles report the same damage in the same way at the same location, the system sounds the alarm. But technology alone is not enough. It also takes experienced professionals with the necessary gut feeling to check out suspicious facts, and sometimes also to withstand threats. Fraud prevention remains a highly sensitive area in which man and machine must work hand in hand.

AI in consulting: support instead of replacement

Many fear that AI will make traditional brokers superfluous. But this concern seems unfounded. Instead, artificial intelligence is becoming a helpful companion in everyday life. It summarizes information, analyzes data, untangles complex policies and creates space for what the algorithm cannot do: Relationship is the magic word here. Advice remains a human business. Those who use AI wisely strengthen their expertise, not their replaceability.

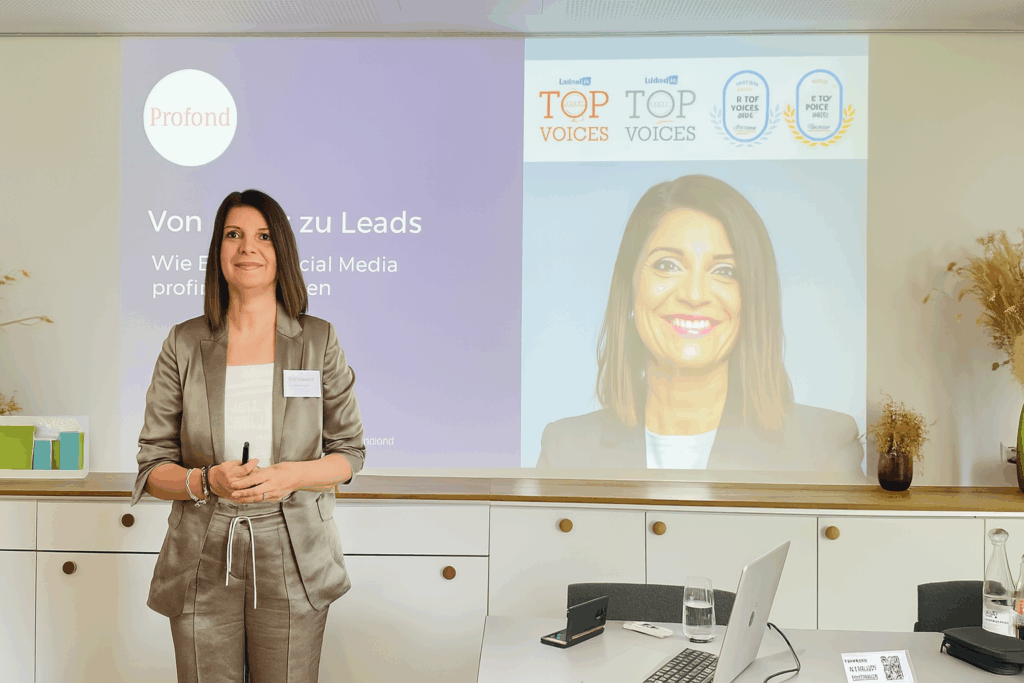

Social media: visibility creates trust

While competition is growing these days, attention spans are shrinking. This is exactly where digital visibility becomes a survival factor. “Likes don’t pay the bills, but leads do,” says personal branding expert Selma Kuyas. LinkedIn is more than just a platform. On the contrary, it is a stage, network and showcase. Anyone who is visible there with expertise, personality and relevance will be found – and booked. For brokers in particular, who often have to contend with prejudices, their own presence on the network offers the opportunity to build trust and create proximity.

Brokerage is facing structural change. New legal requirements, technological possibilities and changing customer expectations are forcing the industry to reposition itself. What is needed is transparency in remuneration, process intelligence in technology, the courage to be digitally visible and a clear self-image. The broker of tomorrow is not just an intermediary. He or she is a consultant, data manager and communications professional. At the same time, he or she will remain one thing above all: a human being at the center of an increasingly complex system.

The second part of the report on the Insurance Broker Forum 2025 will follow on Monday, July 7, 2025.

Binci Heeb

Read also: Why traditional insurance broker business models are no longer sufficient in the corporate sector