From ten-minute healthcare payouts in Chile to processing travel claims in less than a minute, Zurich’s latest pilot projects show how AI is making work easier in finance, marketing and claims, giving employees more time to serve customers.

The second part of the Zurich Innovation Championship Festival will highlight Zurich Cover-More, the Group’s global travel and assistance business, which handles more than one million calls a year.

From hours to seconds

The challenge was to speed up the processing of claims, which often required extensive documentation. Working with AgentricAI, Zurich introduced CLARA, a multi-agent system that reads PDFs, photos and even handwriting, verifies coverage, decides on approval or denial, drafts customer emails and calculates payouts, all under human supervision. The process now takes less than two minutes, 47 seconds on average. Zurich plans to move from the pilot phase to production in Australia and the United States before the end of the year.

Automation with a human touch

In Chile, Zurich’s partnership with InsurTech LISA has already transformed the healthcare business. The company’s no-code claims processing engine now automates around two-thirds of all claims, achieves settlement in less than ten minutes, reduces costs by around a third and increases customer retention to record levels. Savings amount to nearly one million dollars per year, while health insurance renewal rates have reached more than ninety percent.

The finance department finds its co-pilot

Claudia Cordioli, Chief Financial Officer of the Group, sees the finance department as another natural candidate for AI transformation. Her team’s collaboration with Wangari Global resulted in etio, an actuarial co-pilot that replaces tedious reconciliations with automated data management and a “causality engine” that not only explains what happened, but also why. Reporting cycles that used to take days are now completed in a matter of hours, allowing actuaries to focus on insights rather than data collection.

Marketing with context and precision

Zurich’s customer and marketing departments are also increasingly relying on AI. WordLift is developing a semantic “Zurich Marketing Brain” that helps large language models understand product context and customer intent, improving search results and reducing repetitive content work.

In Germany, online insurer DA Direkt partnered with Nexoya to use AI for cross-channel budget optimization, resulting in double-digit revenue growth within weeks. In Australia, Optimizely ‘s experimentation platform enables teams to autonomously test and refine campaigns, resulting in a 60 percent increase in customer retention and 25 percent more closed deals.

Open to disruption

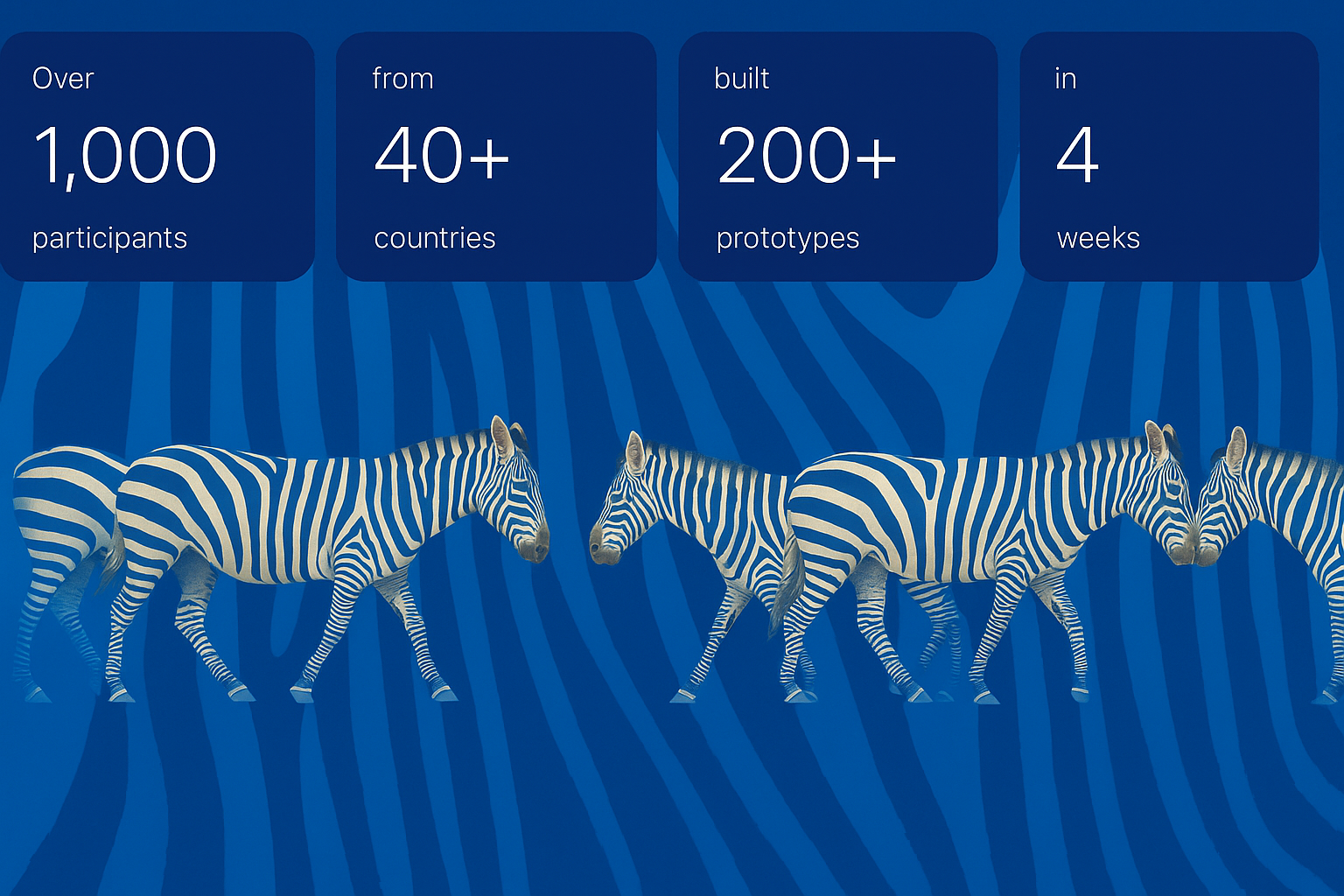

All of these initiatives are based on a clear philosophy: Zurich wants to be a leader, but also open to disruption. More than a thousand participants from forty countries took part in this year’s “Agentic AI Hyper Challenge”, and internal teams shared the stage with start-ups. The company is building an ecosystem where experimentation is expected and human creativity is amplified by machines.

A new rhythm for insurance

The results point to a shift from incremental efficiency to exponential learning. In underwriting, finance, marketing and claims, Zurich’s new AI systems are shortening processes from days to minutes and from minutes to seconds. For customers, this means faster answers and fairer results. For Zurich, it means more capacity, more agility and a clear sign that the future of the insurance industry is already intelligent, collaborative and unmistakably human at its core.

Binci Heeb

Read also: From Bircher muesli to machines: Zurich’s AI offensive in insurance (Part 1)