At the WMC Userday, it became clear that the future of insurance brokers lies in smart software, automation and close collaboration. Between new tools, artificial intelligence and political framework conditions, there is a dynamic field full of opportunities and challenges .

The traditional brokerage business is facing profound change. Customer expectations are rising, regulations are tightening and the flood of data is growing. Thomas Bürki, Managing Director of WMC IT Solutions, summed it up as follows: “We are moving between the past and the future – with one foot still in old processes and the other already in a digital world.

The BrokerStar broker software is intended to master this balancing act: away from pure administration and towards advisory solutions, with clear usability, automated processes and a customer portal that will become a communication hub in the future. “Yesterday’s customer portal was the insurance folder, tomorrow’s is the communication channel,” explained Bürki.

Data, interfaces and AI

The big buzzwords of the day: data quality, automation, integration. Missing interfaces and manual steps cost time and increase the error rate. Bürki put it succinctly: “Unfortunately, we are always at the highest risk of errors when humans have to intervene.”

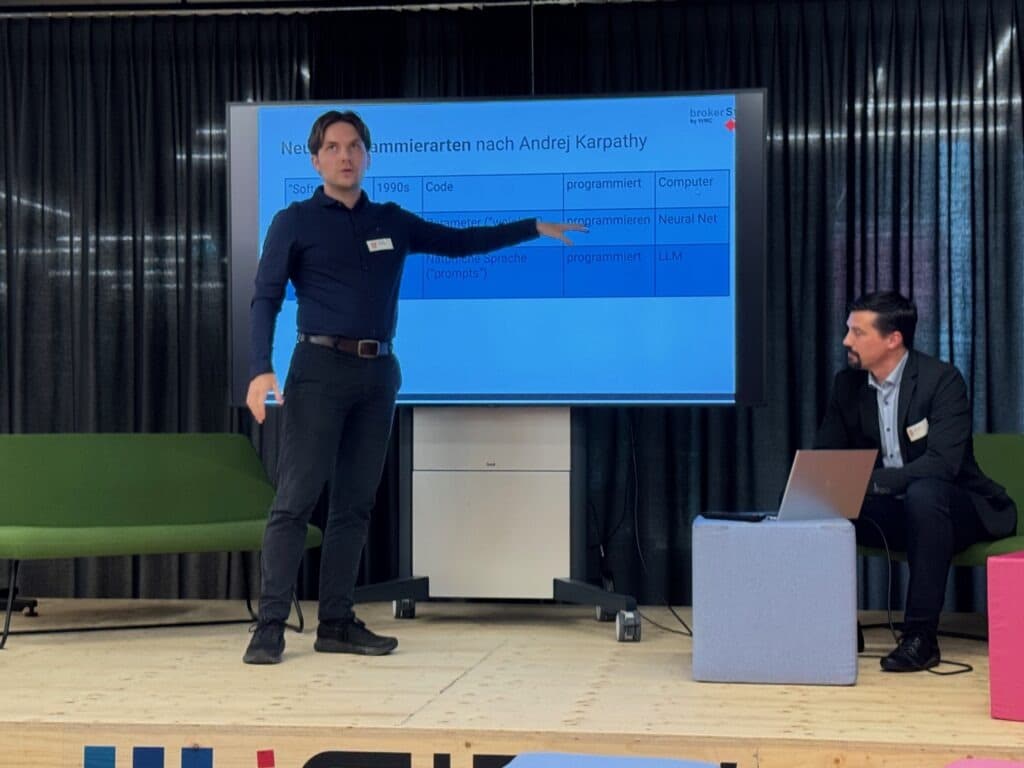

Artificial intelligence plays a key role here. The first models are already being tested to automatically evaluate data and make specific recommendations to advisors. Bürki used an unfinished picture from art history, the statue “David” by Michelangelo: “The contours are recognizable, but the work of art is not yet complete. The AI still has to work on the stone.”

Integration of riskAware

The integration of riskAware was presented at the conference as a practical tool for brokers. The tool helps to systematically identify risks at an early stage and to enter into a structured risk dialog with customers. Instead of focusing solely on individual policies or claims, riskAware enables an overall corporate view: risks are cataloged, responsibilities clearly assigned and documented with simple, comprehensible reports. This creates continuous customer support that not only strengthens trust, but also fulfills legal requirements for documented risk management.

Integrated into the existing broker software and processes, riskAware creates added value by simplifying routine work and at the same time raising the quality of advice to a new level.

New owners, clear strategy

The future of WMC itself was also a key topic at the Userday: The company has been part of St. Gallen-based Vierwald Software AG since the end of 2024. The group takes over specialized niche software companies – from dental technician tools to broker solutions – and focuses on continuity. “We are preserving locations, teams and products and developing them carefully,” emphasized Julius Janda, Chairman of the Board of Directors of WMC. For the brokers, this means: reliability in day-to-day operations and long-term development instead of short-term exit strategies

Media, young talent and visibility

The focus was not only on technology, but also on communication. Binci Heeb, Editor-in-Chief of thebrokernews, presented her content strategy: journalistic quality without a paywall, combined with video interviews, podcasts and AI-supported formats. “Nobody wants to pay for information these days, people google or use AI. That’s why we have to offer added value, for example with professional videos, podcasts or learning formats for the 55+ generation.”

It is particularly important to present the insurance industry as attractive, especially for young talent. “Insurance is anything but boring. You just have to show how exciting this industry really is.”

Regulation as a stumbling block

The growing pressure from regulation and supervision also became clear. Markus Lehmann, President of the industry association SIBA, called out FINMA for financial supervision that burdens brokers without helping clients. He warned urgently: “Asset managers in Switzerland are not supervised as strictly as brokers who have no money in their hands. That is difficult to understand.”

The recurring discussion about banning brokerage fees in the second pillar is also causing unease: “Every few years the topic comes up again, like the groundhog that greets you every day.

The future needs cooperation

The BrokerStar broker software is intended to master this balancing act: away from pure administration and towards advisory solutions, with clear usability, automated processes and a customer portal that will become a communication hub in the future. “Yesterday’s customer portal was the insurance folder, tomorrow’s is the communication channel,” emphasized the management.

The Userday made it clear that the broker industry is on the move. Those who act now will secure a decisive advantage and remain relevant in an increasingly complex market.

Binci Heeb

Read also: WMC IT Solutions AG with new owner Vierwald Software AG