This afternoon, the Swiss insurance industry celebrated its 125th anniversary at the Swiss National Museum in Zurich. The book launch focused on the publication ‘Risk, Solidarity and Mathematics – The Swiss Insurance Industry and its History’. The speeches and panel discussion clearly demonstrated that insurance companies are more than just silent companions: they are an indispensable cornerstone of prosperity and stability.

On 14 December 1900, 21 companies founded the Swiss Insurance Association (SIA) in the station buffet in Olten. Then, as now, the central question was how to balance regulation, market mechanisms and solidarity in such a way as to ensure Switzerland’s economic success. ‘From the outset, the insurance industry was not only an economic force, but also a socio-political one,’ emphasised Prof. Tobias Straumann, economic historian.

Regulation as a competitive advantage

The early, strict requirements imposed by the federal government – from capital reserves to state supervision – proved to be a long-term advantage for Switzerland as a business location. Swiss insurers became synonymous with stability, with reinsurance as a global export hit. Even today, the issue of regulation remains a sensitive one. ‘We need regulation, but it has to be smart. Overregulation prevents innovation,’ said Karin Walter-Sperber, Director of Economic Affairs for the Canton of Zurich.

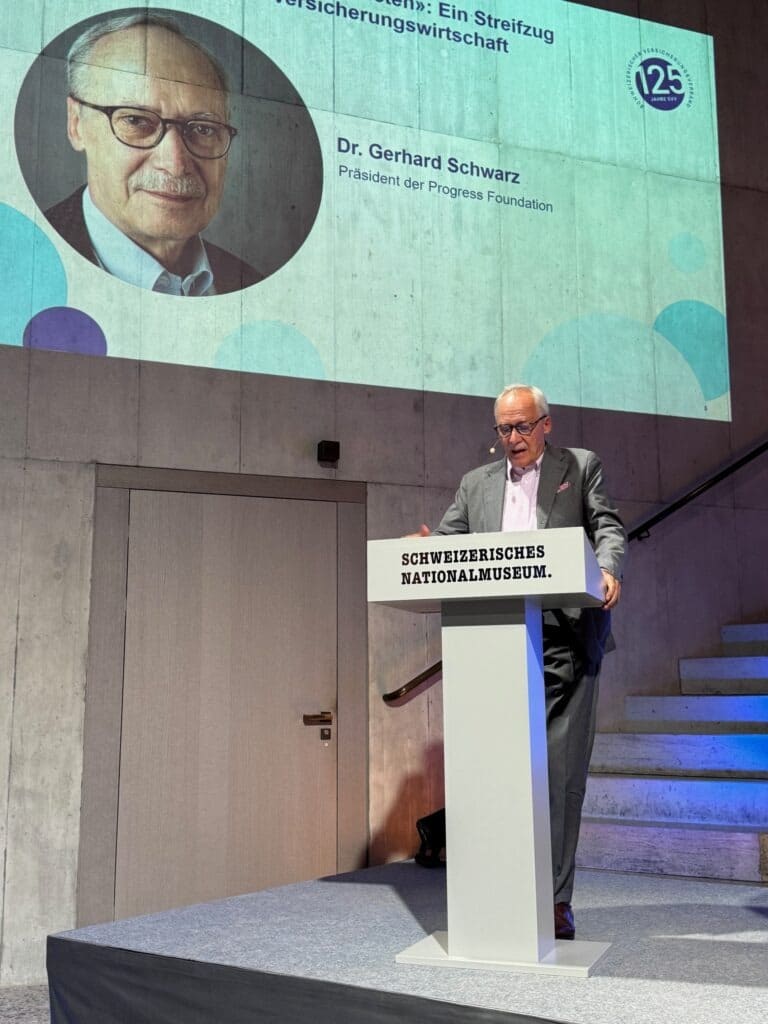

The critical observer: Gerhard Schwarz

Gerhard (Gerry) Schwarz, former business editor of the Neue Zürcher Zeitung and current president of the Progress Foundation, made a special point. He recalled that insurance companies were long considered ‘boring’ – unjustly so, he emphasised. The diversity of the authors of the anniversary volume shows how dynamic and influential the industry actually is. His conclusion: the work has the potential to become a standard work on the insurance industry.

Solidarity and personal responsibility

The discussions highlighted the tension between collective protection and individual responsibility. Social welfare systems such as the AHV are based on compulsion and redistribution, whereas private insurance is based on mathematics and competition. Claudia Wirz, editor of the anniversary volume, summed it up: ‘Our prosperity, the way we live today, would be unthinkable without insurance.’

Tomorrow’s challenges

Climate risks, cyber attacks, demographic change – the risk landscape is becoming more complex. The SIA therefore sees itself in a dual role: guarantor of stability and driver of innovation. ‘New technologies are constantly creating new types of insurance, from cars in the 20th century to cyber risks today,’ explained SIA President Dr Stefan Mäder.

A pillar of prosperity

The anniversary celebration at the National Museum made it clear that insurance not only covers damage, it also secures trust, stability and economic development. 125 years after its founding, the insurance industry remains a key player in Swiss society: invisible in everyday life, but indispensable as a foundation.

125 years after its founding, the SVV is more than just an industry representative. It is part of Switzerland’s political architecture and is in constant dialogue between regulation, the market and society. The insurance industry thus remains not only a silent champion, but also a cornerstone of Switzerland’s economic and social model.

Binci Heeb