Whether chatbots, embedded insurance or preventive services: Artificial intelligence is changing the way insurers communicate with their customers and opening up new opportunities for real added value.

Customer expectations are changing rapidly. Anyone who shops on Amazon in seconds or receives recommendations on Netflix in seconds expects a similarly smooth experience with insurance. The days when claims notifications took weeks or advice was only available between 9 a.m. and 5 p.m. are over. Customers want answers in real time, on the channel of their choice, be it email, WhatsApp or social media. Providers such as SuperChat show how it’s done: their platform bundles all inquiries centrally, integrates AI-supported processes and enables personalized communication at the touch of a button – in compliance with data protection regulations and scalable.

It’s not just about speed, but also about well thought-out customer journeys. Every step is analyzed and optimized, from the first contact to the conclusion of the contract to the processing of benefits. The vision: insurance processes that feel as intuitive as ordering a pizza – only with more substance.

AI as a helper, not a replacement

Despite automation, one thing remains clear: people continue to play a central role. Artificial intelligence does not replace consultants. It relieves the burden. It takes over recurring tasks, recognizes patterns in customer data, answers standard questions or reminds people of appointments. This creates space for real human interaction where it counts.

One example: WhatsApp appointments including reminders reduce no-shows, i.e. missed consultations, without anyone having to make a phone call. The customer automatically receives a personal message: “Dear Susanna, is your appointment tomorrow at 10 a.m. still convenient?” – with an option to confirm or rebook. This saves resources and increases commitment. “We automate where it makes sense – and leave room for real dialog,” is how a SuperChat spokesperson sums it up.

Embedded insurance as a growth driver

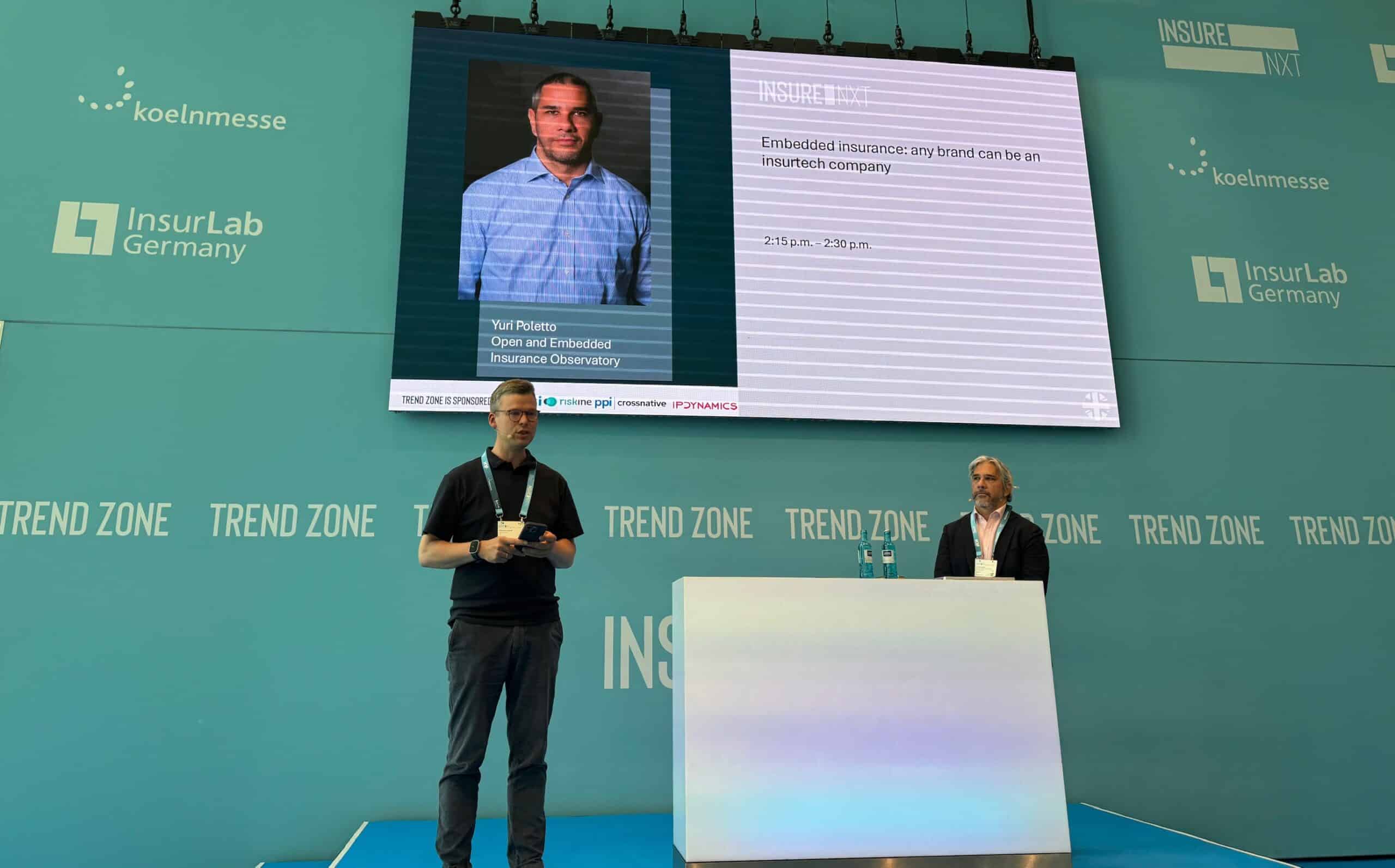

Embedded insurance is a particularly exciting field. This involves integrating insurance offers where the customer is already moving: when buying a car, during the travel booking process or in the online store. “Insurers need to go where customers already are,” explains Yuri Poletto from the Open & Embedded Insurance Observatory. The customer takes out insurance directly at the time of purchase, without media disruption, simply, quickly and comprehensibly.

This strategy not only lowers acquisition costs, but also enables tailor-made products for target groups that were previously hard to reach, such as young people or occasional buyers. It also creates new touchpoints for personalization and upselling. Embedded insurance transforms sales from a search to a casual decision – with enormous potential for reach and customer satisfaction.

Emotion beats efficiency

AI can be fast and efficient – but that’s not enough. Insurance is a matter of trust. In sensitive moments, such as in the event of a claim or illness, empathy counts. Customers want to feel understood, not processed. This is why many insurers rely on hybrid models: AI takes over the back end, humans the front end. The AI processes preliminary inquiries, structures data and suggests possible courses of action. Humans make decisions and provide empathetic support.

“The art lies in using technology in such a way that it doesn’t replace humanity, but enhances it,” was how one CIO summed it up at the trade fair. After all, the true competitive advantage arises where digitalization creates tangible benefits and without neglecting the relationship level.

Digital services with attitude

What remains is a clear trend: the insurer that can combine trust, proximity and efficiency will prevail. Whether at established providers such as Provinzial and AXA or agile start-ups, it is clear everywhere that AI is not an end in itself. It is a tool for improving the customer experience, accelerating processes and enabling new business models.

The future belongs to those who combine technology with attitude, data-driven but human-centered. Or as one board member put it in a nutshell: “I don’t want technology, I want solutions that solve my problem.” The true power of AI lies in this attitude.

Binci Heeb

Read also: Tech meets tactics – How AXA scales innovation on three levels