Risk-!n 2025 (May 11 – 13, 2025) was once again an event to attend this year. It showed that record losses due to extreme weather events, growing insurance gaps and rising expectations of companies are repositioning the insurance industry as a strategic partner in dealing with climate risks.

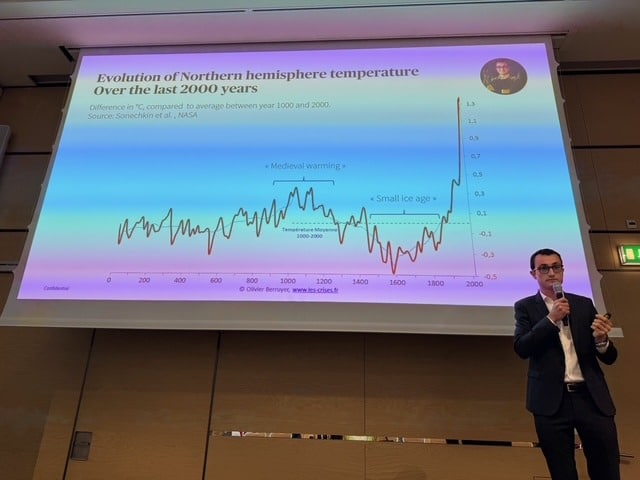

Climate change is no longer an abstract threat, but a bitter reality. The economic losses caused by natural disasters in 2024 amounted to 368 billion US dollars. Dom Probyn from the Climate Risk Advisory Team at Aon quoted this figure and added: “It’s not just about the weather, but about a new dynamic of global risks driven by urbanization, resource scarcity and economic complexity.”

2024 was the hottest year since records began – and one of the six most expensive years for natural disasters worldwide. The costs for companies are rising, as are regulatory pressure and social expectations.

The big gap: 60 percent are not insured

One figure is attracting particular attention: only around 40% of economic losses were insured. This means that 60 percent of losses remain uncovered, creating a dangerous “protection gap”. For insurers like Aon, this is a call to action. After all, this gap not only highlights the lack of protection, but also the enormous potential for preventive and data-based risk management solutions.

More than just policies: insurers as data providers and risk consultants

The insurance industry has decades of experience with weather risks – and one of the world’s most comprehensive climate databases. Aon, for example, publishes the annual “Climate and Catastrophe Insight” report, which is one of the industry’s standard works. “If you really want to understand what is happening in terms of climate – then read these figures. They show where we stand,” says Probyn.

The role of insurers is thus changing from loss adjusters to strategic risk partners. Companies are increasingly benefiting from tools such as risk models, scenario analyses and location assessments that go beyond traditional insurance services.

The new risk mix: climate meets urbanization and supply chains

The new risk dynamics are particularly evident in convective storms. These “summer storms 2.0” – as Morgan Richoz, Senior Consultant Engineer at FM Global, called them – are more violent, more frequent and more unpredictable. “The same region today can expect 12 percent more precipitation during a thunderstorm than 100 years ago,” he explained, referring to the Clausius-Clapeyron effect. The result: lightning damage, flooding and total infrastructure failures are increasing rapidly.

FM Global documented the thunderstorm of 21 June 2024 in Graubünden, for example, which brought more than 120 millimetres of precipitation within three hours, claimed several lives and paralyzed the A13 for weeks.

Climate risk as part of every investment decision

Companies are required not only to monitor climate risks, but also to integrate them into every investment and location decision. Whether building a new factory, supply chain or capital investment, the climate is increasingly becoming an economic risk factor. For Probyn, it is clear: “Climate risks are not an isolated threat – they are closely interwoven with other risks. That’s why they need to be strategically considered and anchored.”

Binci Heeb

Read also: Risk-! The event for risk management