The way insurers communicate with their brokers is no longer fit for purpose. Millennials and Gen Z no longer want long meetings or static brochures. They expect concise, visual, and personalized information at their fingertips. Yet most carriers still rely on outdated tools that fail to engage.

For Chetan Saiya, founder and CEO of Zoomifier, this “broken infrastructure” between carriers and brokers represents both a challenge and a massive opportunity. His video-driven sales enablement platform promises to turn static content into dynamic, personalized experiences, helping insurers reconnect with their distribution partners and, ultimately, with a new generation of customers.

Chetan, you built Zoomifier from scratch. What was the original vision, and how did you move from media and entertainment, and sports into insurance?

Around the turn of the century, as the internet and digital age fully dawned on us, businesses took an easy shortcut with content that always bugged me. They simply converted paper based sales material and transparencies into PDFs and PowerPoints. While they eliminated the physical medium (paper and foils) , neither of them fully leveraged the interactive rich media and tracking powers of the digital medium to better engage with their customers. So after my previous venture, Assetlink was acquired by SAS Inc., I started Zoomifier to help businesses enable and coach their sales teams to better engage their customers. This was the original vision. At Zoomifier we enable businesses to easily create, manage, personalize, distribute and track engagement with video-rich content.

As is required for any startup venture, we first focused on the early adopters for whom video and other rich media were essential to communicate the experience of their offerings. This included industries such media & entertainment (for ad sales), sports (for selling sponsorships), hospitality (for selling event spaces) and real estate (for selling and leasing properties). Insurance was nowhere on the radar for us.

Post COVID, we had acquired a few insurance carriers as customers without any proactive or focused outreach. Initially, we didn’t pay much attention but at the end of the second year we noticed something that blew our minds away. In their first year, they were using Zoomifier to enable their sales teams with traditional PDFs and PowerPoints while they were working on transforming their content to more engaging and interactive content. Once that transformation was complete, in the second year they were creating six times more video-rich content, sharing it with eight times more contacts and seeing a 300% increase in customer engagement compared to the previous year! We had never seen such a rapid performance improvement across multiple customers in any industry. This is when we decided to seriously focus on the insurance industry.

What did you learn from talking to 45 brokers about their daily challenges?

The first thing we did was to reach out to our insurance customers and ask them their reason for adopting Zoomifier. One of them described the challenges they faced in their relationship with broker partners and how Zoomifier was helping them overcome these challenges. Another insurance carrier customer went a step further. In addition to describing the challenges they faced with their distribution partners, they invited us to talk to them so that we can get better insights into their problem. We, of course, jumped at that opportunity.

In talking with both the brokers and agents as well as the sales, marketing and distribution and partnerships teams at insurance carriers we learnt the following:

- The brokers did not find the sales content supplied by the insurance carriers to be very useful in helping them close the deals. Most of the information was complex, long, and text heavy. It was not easy to simplify and personalize this information to address buyer’s requirements. So they made up their own content for the buyers!

- The rapidly emerging Millennial and Gen Z buyers prefer receiving relevant information over meetings. However, they also have a very low attention span and hate reading. The broker channel was struggling to engage this new generation of buyers using traditional sales tools and content.

Overall, we learnt that brokers gravitate towards promoting offerings of the insurance carriers that make it easy for them to sell faster.

You said the infrastructure between carriers and brokers is “broken.” What exactly isn’t working?

- There is no easy way for brokers to find the most relevant and up to date content from the carriers or have easy access to coaching that can help them position the offerings appropriately.

- It is not possible to easily personalize the information supplied by the carriers so that it can relate to the buyer’s requirements.

- The carriers have no insights into how their content is used by the brokers to engage customers.

How do generational changes, especially the habits of Millennials and Gen Z, reshape broker engagement?

- The new generation of buyers prefer receiving relevant information over meeting with agents

- They hate reading text heavy documents and prefer to watch videos

- They have a very low attention span and get easily distracted

How does Zoomifier transform the way carriers and brokers communicate?

Zoomifier has introduced 5 innovations that positively impact the carrier – broker relationship:

- Zoomifier’s personalized engagement Spaces make it extremely easy for brokers to access the most relevant product information and coaching from the carriers.

- Zoomifier’s Narratives transform existing PDF based product information into highly personalized, bite-sized videos that are easier to understand and more relevant.

- Zoomifier CustomShow transforms existing text heavy PDFs and PowerPoints into video-rich interactive content libraries that can be easily personalized by the brokers without breaking regulatory or brand compliance.

- Zoomifier Digital Library makes it easy for insurance carriers to manage and distribute unlimited amounts of video-rich content to brokers with complete access control, password protection, automated content expiry and version management. Zoomifier eliminates the need for downloading any content. All information is manipulated, shared and viewed within Zoomifier environment

- Zoomifier Analytics tracks how, where and when every content item is used and shared by the brokers as well as how buyers engage with this content. This powerful insight enables brokers to clearly understand buyer’s purchasing intent as well as enables the carriers to determine how well their content is performing.

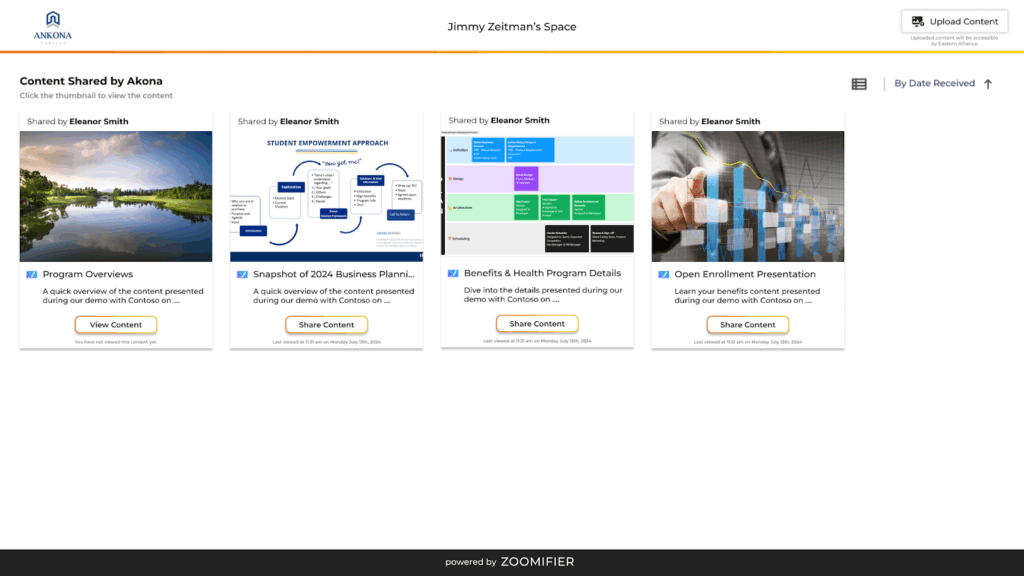

What does a “personalized engagement space” look like in practice?

Traditionally, the availability of most of the product information is communicated from the carriers to the brokers via email. As a result, the relevant information is scattered across a broker’s inbox. Brokers often download this information on their desktops or network drive. This breaks the connection and the information gets quickly outdated.

In contrast, Zoomifier’s Space is accessible as a single link that is accessible across the whole brokerage or personalized for each broker. The broker simply clicks on the link and all of the relevant information is accessible. Each link is protected through multi-factor authentication so only the relevant members can access the information. Furthermore, the brokers can easily share information with their clients with links to individual content items. The content is always guaranteed to be up to date.

All of the interactions by the brokers and engagement by the customers are completely tracked and available as analytical insights.

Here is a screenshot of the one such Space:

You mention transforming PDFs into highly interactive, video-based experiences. Can you give an example of how that changes the sales process?

Here are two very commonly used examples:

- Coaching: Instead of requiring broker agents to attend classroom sessions or webinars, insurance carriers can now create bite-sized videos on relevant topics that agents can reference as and when required (ondemand training). Distributing such training through Zoomifier enables the insurance carriers to understand how well the agents are coached on their product offerings.

- Personalized Client Engagement: In response to a client inquiry, instead of sending text heavy and long PDFs, the insurance carriers or brokers can create 2-3 minutes personalized videos that quickly walk through relevant parts of the PDF highlighting how those features meet client’s needs. The video also shows them talking to the client. This is almost like meeting in person and explaining to the client.

Insurance carriers have identified dozens of similar use cases that improve their client engagement and accelerate the sales process. These use cases are applicable across Life & Annuities, Property & Casualty, Health & Benefits and more.

Why should carriers, rather than brokers, finance this engagement technology?

There are several reasons:

- At the end of the day, the clients are buying insurance carrier’s products. So it is in the interest of the insurance carriers to learn how the broker partners as well as their customers are engaging with their content.

- Carriers have the processes and resources to adopt, deploy and manage this infrastructure.

- Carriers are the ones creating all the content and hence they need a way to completely control access and manage versions.

A few large insurance brokerages have purchased Zoomifier on their own but there are thousands of smaller agencies who do not have adequate resources to manage it themselves.

What kind of analytics can carriers gain from these interactions, and how can that data drive smarter marketing or training decisions?

Zoomifier helps carriers and their distribution and partnership executives gain real-time, multi-dimensional insights:

- Which are the most active brokers?

- What products are they promoting the most?

- What content do buyers engage with the most to make their buying decisions? What content is helping with customer retention? What content is effectively promoting best practices that minimize claims?

Where are the customers engaging with this content? At what time of the day? On what devices?

Equipped with this information marketing managers are able to fine tune their content to improve customer engagement. The analytics help distribution and partnership managers identify the brokers who may require additional coaching on specific products.

You’ve talked about using AI for personalization and content generation. What role do you see for AI in the next stage of sales enablement?

While experimenting with AI in their IT labs, most insurance companies are wary of the dangers posed to personally identifiable information (PII) as well as hallucinations caused by AI that could misrepresent carriers and cause regulatory compliance issues. In this context, sales enablement provides a very low risk approach to try out AI in the field and measure the efficiency gains.

Here are a few examples of where generative AI is very helpful in sales enablement:

- Generative AI and associated technologies can automatically convert text heavy PDFs into bite-sized coaching videos for the brokers and product explainers for the customers.

- AI and semantic searching helps automate personalization of product information based on the client’s insurance needs.

- AI can automatically tag and index content so that the users can make intuitive, natural language requests to find the relevant content.

- AI can interpret analytical insights to coach brokers on how to best engage customers.

None of these examples require use of any PII data. All of the generated information can be verified by the brokers before sharing them with the users.

How can tools like Zoomifier reduce the need for coaching and training webinars while keeping salespeople effective?

Most coaching and training webinars are ineffective because the attendees are multi-tasking during the webinars and barely retain any information after a few days. In contrast, Zoomifier based bite-sized coaching and training content easily accessible to the salespeople enables them to train on demand in response to an inquiry by the customer. Knowing that they have easy access to the relevant coaching improves their confidence in promoting the products for which such coaching is available.

You mentioned interest in collaborating in the DACH region. What makes this market interesting or challenging?

In the past, I have always found DACH region business managers being highly pragmatic and process oriented. They don’t impulsively jump on to the technology but instead verify the relevance of the technology and then methodically roll it out. This results in longer term relationships and innovations that actually benefit the users.

This is why I find engaging with business managers in the DACH region interesting and productive.

What’s your message to insurance executives who still see “digital engagement” as just another buzzword?

If you do not grasp the relevance of “digital engagement” in making it easier for your broker agents to promote your brand with the next generation of buyers then:

- You risk losing the mindshare of your broker partners

- Your customer acquisition and retention will be negatively impacted.

If you could describe the future broker–carrier relationship in one word, what would it be?

“Essential”.

The questions were asked by Binci Heeb.

Chetan Saiya: CEO, Zoomifier Corporation a pioneer in video-rich sales enablement focused on the insurance industry.

He is a serial entrepreneur and founder of successful, self-funded startups that have been acquired by larger software companies. His secret to success is that he believes in deeply understanding the problems faced by an industry and then working relentlessly to innovate a new category of software to solve them.

Chetan has MS in Computer Engineering from University of Notre Dame, USA and B.Tech in Electrical Engineering from Indian Institute of Technology, Mumbai, India.

Read also: The future of the insurance industry: a look at five innovative insurtechs