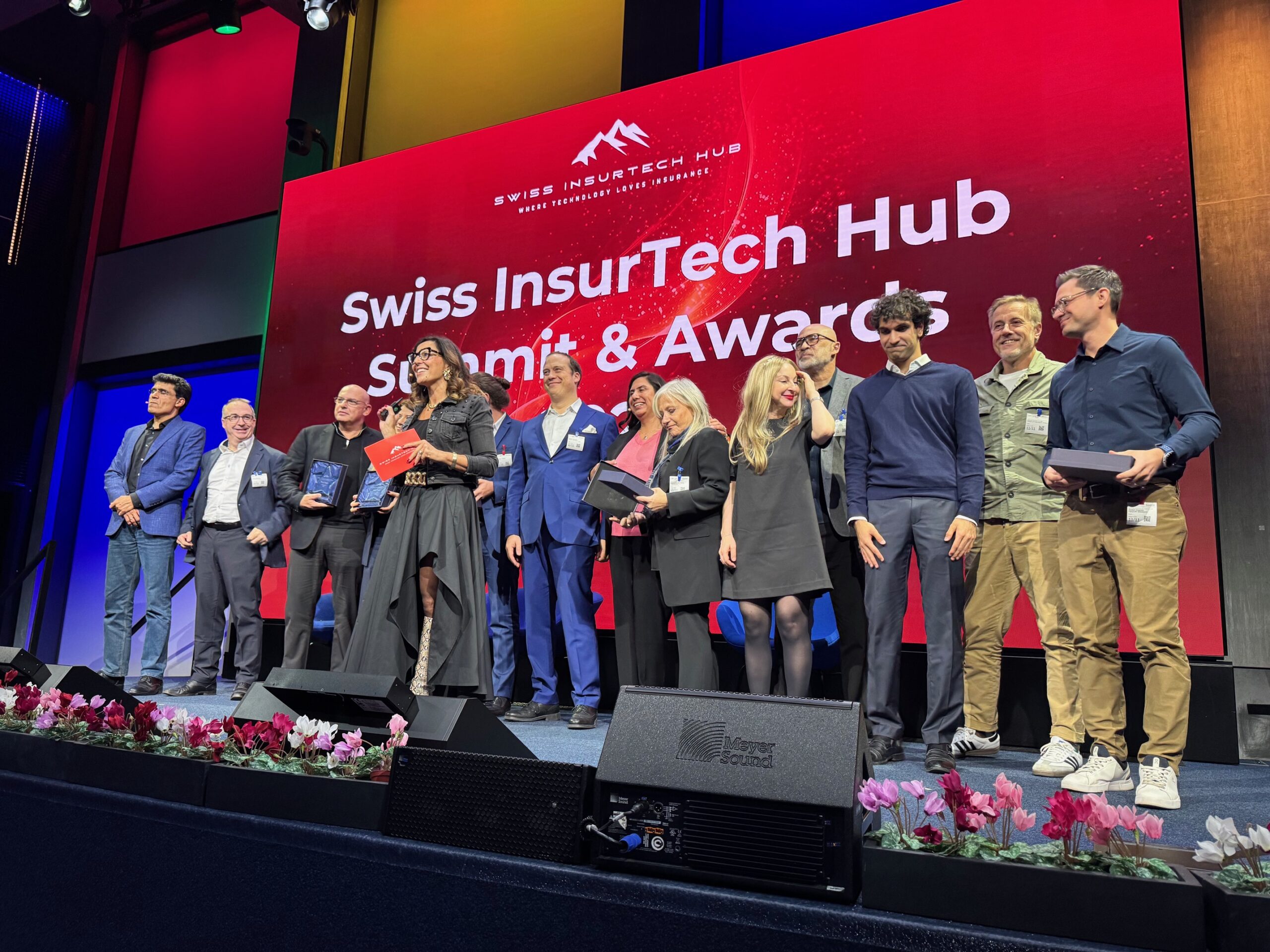

Nine finalists, one unable to attend, four category winners and one overall winner: the Swiss InsurTech Hub Summit & Awards 2025 celebrated the best young companies in the industry. With ideas ranging from climate risk analyses to cybersecurity solutions, the start-ups proved that the future of insurance has long since begun.

Moderated by Sharan Kaur, the finalists each presented themselves in three minutes. From climate data start-ups to middleware platforms and cyberrisk analysis tools. “They don’t think in endless committees, they just get things done,” said Luthra about the founders. A total of 62 companies from over 20 countries from Mexico to Singapore, including Switzerland, applied.

Mitigrate: Flood protection with satellite data

Laurent Olivier Feuilleaubois presented Mitigrate as an AI and satellite data-based tool that precisely assesses flood risks and calculates the vulnerability of individual buildings. Insurers have good data on hazard and exposure, but hardly any reliable models for vulnerability, he explained. Mitigrate closes precisely this gap and thus enables precise loss estimates, better prevention measures and greater customer loyalty, for example because every second customer is prepared to implement recommended protective measures after a loss.

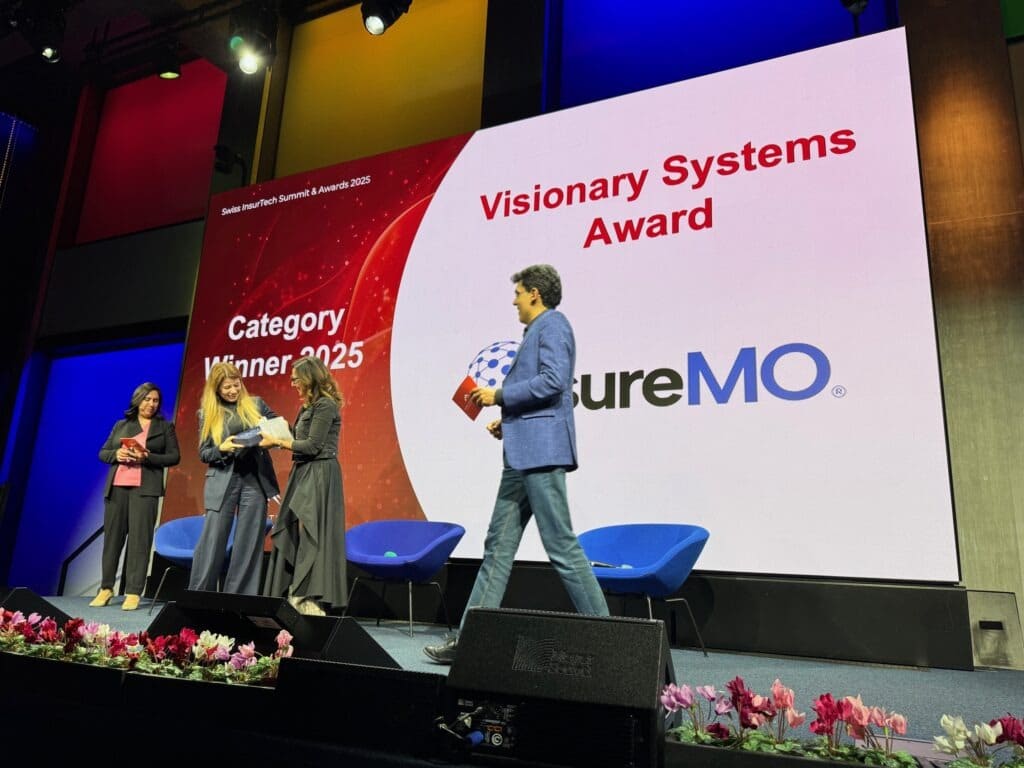

InsureMO: Digitization without system disruption

Antoniya Karakuleva, Sales Director at InsureMO presented the company as a global middle-office platform that allows insurers to bring new products to market in days rather than months. Many insurers fail because of slow legacy systems, she explained. That’s where InsureMO comes in: with over 17,000 pre-built product modules, 100 million policies processed per day and more than 10,000 insurance APIs for every type of distribution channel The platform is completely cloud-based and works headless, so it complements existing IT without the need to change systems.

UpQUAI: AGI ready

Stefan Majnek, CEO, presented UpQUAI as a solution to a core problem in the industry: Insurers can only automate processes if they really understand them. However, 80 percent of operational knowledge is in the heads of employees and is not documented, while hundreds of thousands of experts are about to retire. UpQoAI captures this hidden knowledge via screen and voice recording directly from day-to-day work and uses it to build a company-wide knowledge graph that can be used for automation, process analysis and onboarding. The result: faster processes, less dependence on individuals.

Starmind: Human intelligence, supported by AI. Anytime. Everywhere.

Joerg Ruetschi, Entrepreneur and Charlie Händel, Global Account Director presented Starmind as a platform that taps into the most important capital of insurers: the knowledge of their employees. Since 80 percent of expert knowledge remains hidden in people’s heads and not in systems, this results in knowledge gaps, inefficient decisions and slow processes. Starmind combines human expertise with AI to make this knowledge discoverable in real time and make organizations significantly faster, more precise and more resilient. The platform recognizes who has what knowledge in the company and provides answers where they are needed.

Citalid: Cyberrisk, AI and automation

Maxime Cartan, co-founder of Citalid, showed how his company is finally making cyber risks quantifiable and insurable. Instead of waiting for rare historical loss data, Citalid uses an AI-based threat intelligence model that calculates the probable attack scenarios, their frequency and the financial impact for each company. This enables insurers to underwrite risks more precisely, diversify portfolios and recommend specific preventive measures to customers. Cartan’s core message: cyber is the “most profitable and scalable line of business of the next decade”, but only if it is understood to be data-driven.

Ledgertech: Embedded Insurance

In his pitch, Eran Tirer, CEO of Ledgertech, showed how outdated, often decades old, many of today’s insurance core systems are and how they are barely compatible with modern technology. Ledgertech offers a cloud-native, AI-enabled core platform that enables innovation, speed and embedded insurance. With an AI copilot, digital products can be developed quickly and AI can be integrated seamlessly. Transformation does not have to be radical, said Tirer, Ledgertech complements legacy systems step by step instead of with a “big bang”.

Photocert: Reduction of fraud and abuse

Pasquale Saviano, CEO and founder of Photocert, showed how easily today’s claims processes can be deceived by manipulated or AI-generated images. Since 80 percent of claims are based on unverified photos and forgeries are hardly recognizable with the naked eye, new verification mechanisms are needed. Photocert uses deep learning models that recognize manipulations directly in the image and reliably verify authenticity. The solution is generator-agnostic, works with simple traffic light indicators and can even legally certify images.

ViteSicure: Simplified life insurance

Eleonora Del Vento, CEO of viteSicure, explained how her company is radically simplifying life insurance and making it accessible to new customer groups. The starting point is the growing financial vulnerability of many people: In Italy, every second family saves nothing, and only 6 percent of the target group would have life insurance. The company closes the gap with a fully digital, scalable platform that makes it possible to take out life insurance in three minutes. The result: a 36 percent conversion rate.

Solva: Faster claims processing

Sorena Amini, Co-Founder and COO of Solva, showed how her company transforms the most complex claims with domain-specific AI. Instead of relying on rigid rules, Solva’s model reads thousands of pages from policies to invoices to appraisals and supports claims specialists with precise recommendations, missing documents and relevant exclusions. The result: faster decisions, higher customer satisfaction and better loss ratios.

The winners of the Swiss InsurTech Hub Awards

The jury honored four companies. The

The overall winner of the evening was Citalid and was celebrated with a standing ovation, a sign that innovation in the industry is not only encouraged, but lived.

The awards made it clear how closely linked technology, sustainability and customer centricity are today. Startups like Mitigrate and InsureMO show: Insurance can be fast, smart and meaningful if you let it.

Binci Heeb

Read also: Innovation, AI and customer experience at the Swiss InsurTech Hub Summit & Awards 2025