Swiss health insurance is caught between rising premiums, demanding customers and the pressure for digital transformation. The latest Deloitte study shows that price remains the trump card, digitalization is a minor matter and genuine healthcare partnerships usually still need to grow.

According to the Deloitte study, the Swiss health insurance market will remain highly dynamic in 2025: only 37% of those insured have never changed health insurer, which is clear evidence of the rampant “switching virus”. The main reason for this is anything but surprising: the premium. An impressive 67% say they are considering a new insurer due to rising costs, while digital services and loyalty programs only encourage around 5% to stay. The famous switching threshold is currently an additional monthly charge of around CHF 30. If the premium rises above this, 72% of customers seriously consider switching.

Physical or digital? The consultant remains relevant

Despite all the digitalization, personal contact is not being phased out. Over 50 percent of those seeking advice prefer to talk to an advisor when it comes to details. When it comes to taking out policies, on the other hand, policyholders are digitally savvy. Almost 60 percent of new policies are already being taken out via online channels.

Desired partner health? Lots of room for improvement

The figures speak for themselves: only 43% of those insured see their health insurance company as a real health partner. There is room for improvement in the relationship of trust with the industry. Only around a third believe that their provider is committed to an affordable healthcare system.

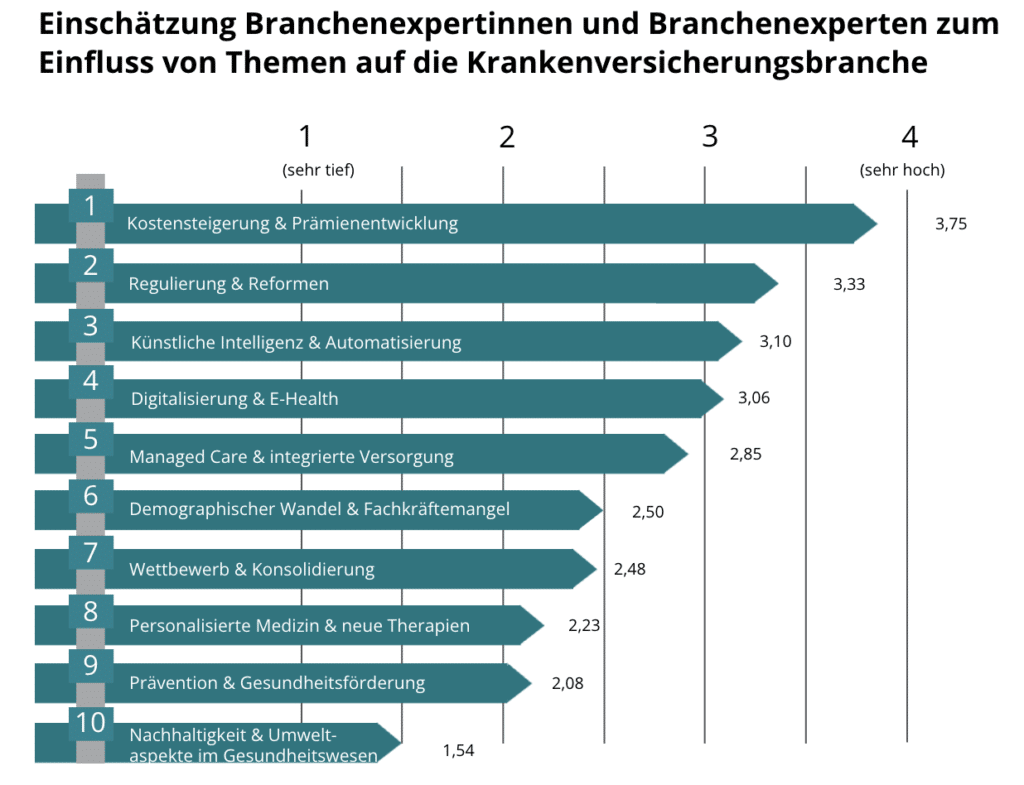

The insurers’ perspective: pressure for reform and hopes for AI

The insurers’ agenda is as follows: Cost pressure, political reforms and technological upheaval. Industry professionals are increasingly turning to artificial intelligence to streamline processes and reduce costs. According to Deloitte, however, sustainability remains a marginal issue. A look at the annual reports shows that profitability and the fight against rising healthcare costs dominate the agenda.

The big picture: Swiss costs in international comparison

According to Deloitte, the healthcare system devours a whopping 11.7 percent of gross domestic product. This puts Switzerland in the same league as other Western European countries. In contrast to many of its neighbors, however, the costs are borne more directly by the insured: The system of per capita premiums makes the price increase particularly noticeable, and co-payments (deductibles, dental costs, etc.) have also risen further in an international comparison.

Also worth noting: compulsory health insurance (OKP) is becoming rapidly more expensive. At 140, the premium index is significantly higher than the nominal wage index (110). This is measurably reflected in switching behavior: Deloitte is once again forecasting an above-average switching rate of 12% for 2025, which is significantly higher than the long-term average of 7.4%.

Health insurance remains a hot topic that will keep both households and the industry busy. For insurers, the motto remains: keep an eye on the price, live true partnership and make strategic use of the opportunities offered by digitalization, otherwise there is a risk of constant bloodletting in the customer base.

Binci Heeb

Read also: Between hope and implementation – Generative AI promises efficiency