As industries adapt to a post-pandemic world, the insurance sector faces growing challenges and opportunities. The Swiss InsurTech Hub (SIH) recently hosted its third Summit and Awards, bringing together industry innovators to showcase transformative initiatives designed to propel the sector to new heights.

At the Google Auditorium in Zurich, Silvia Signoretti, President and co-founder of SIH, emphasized the goal of the summit: to build a global community of innovators in the field of insurance technology. Signoretti emphasized continuous innovation and collaboration to meet the dynamic needs of customers and society. She thanked the sponsors and emphasized the joint efforts to promote the insurance sector.

Deep insights into technology and innovation: insights from Google Cloud

Nigel Walsh, Global Head of Insurance at Google Cloud, shared his background and spoke about the importance of Zurich to the tech giant, in the city where Google has been operating for 20 of its 26 years. He focused on the role of AI and its potential for transformative change in the insurance industry. Walsh and Kilian Blum from Swiss Re discussed Swiss Re’s AI strategy:

- Out-of-the-box Co-Pilot capabilities: Tools like GitHub’s Co-Pilot complement common tasks, but it remains a challenge to grasp their full value.

- Use of large language models: These models are integrated into the core insurance processes and improve decision-making and efficiency.

- AI agents for process automation: AI can potentially automate processes, although Swiss Re is careful to weigh up the risks and benefits.

Blum pointed to the push by managers towards AI and its traction in the area of risk assessment and assessed the value of AI based on acceptance, process acceleration and error reduction.

Innovative strategies for a secure digital future

Daljitt Barn of Tokio Marine discussed the evolution of cyber insurance and emphasized the importance of AI governance and early technology investment. Barn, who has worked in cyber for 30 years and in cyber insurance for 10 years, outlined Tokio Marine’s global governance and innovation strategies. He was interviewed by Shira Kaplan, cybersecurity entrepreneur and founder of Cyverse, who highlighted investment in AI, cloud security and recovery as areas of focus.

Accelerating speed and innovation: from the race track to the data track

A lively discussion with Stuart Bailey, Chief Infrastructure Officer of Aston Martin Formula One, and Kathrin Braunwart, Chief Information Officer of AXA Switzerland, moderated by Kathrin Kind-Trüller, Director for AI & Advanced Analytics at Cognizant, explored how rapid innovation is driving both the racing and insurance worlds. Despite different dynamics, both industries value speed, security and continuous improvement.

Strengthening customers through strategic partnerships in the insurance industry

Thomas Steiger, Head of Sales at Zurich Insurance, and Markus Koch, Chief Product Officer Insurtech at Swisscom, discussed why telecommunications providers work together with insurance companies. The reasons include additional revenue streams, leveraging existing sales channels, increasing customer loyalty, data personalization and digital transformation. Swisscom believes that partnerships improve customer value and interaction and promote a better future.

Securing the future: Innovative insurance models for the new world

Liza Engel from Deloitte and Coenraad Vroelijk from CarbonPool discussed the integration of sustainability into insurance. CarbonPool offers property insurance for carbon removal that addresses accidental emissions and permanence issues, rather than traditional financial compensation. The discussion highlighted the challenges and opportunities of integrating sustainability into insurance, addressed the regulatory cooperation with Swiss authorities (Finma) and dealt with the handling and obligation to reduce CO2 emissions.

Heidi Goes AI

The “Heidi Goes AI” project in collaboration with the Swiss Consulate in San Francisco aims to reinterpret the cultural icon “Heidi” with the help of AI and art. Peter Otto Büttner, President and Director of the Heidi Archive, and Peter Polzin of the Heidiseum Foundation shared their vision, which includes a Heidi heritage center in Zurich. The book “Heidi”, written by Johanna Spyri in Zurich 140 years ago, has been translated into over 70 languages and published in various media, including the legendary anime from 1974.

Eight start-ups present innovative solutions

Start-ups Calvin Risk, Coinnect, Exploris, Ledgertech, Quantev, Riskwolf, s.360 life underwriting and Yukka Lab presented solutions ranging from AI in medical diagnostics, cyber risks enabling insurers and customers to quickly create digital-first insurance, optimizing health insurance claims, enabling faster claims processing for weather insurance, automating and improving the life insurance underwriting process and improving investment, risk management and compliance by detecting relevant events.

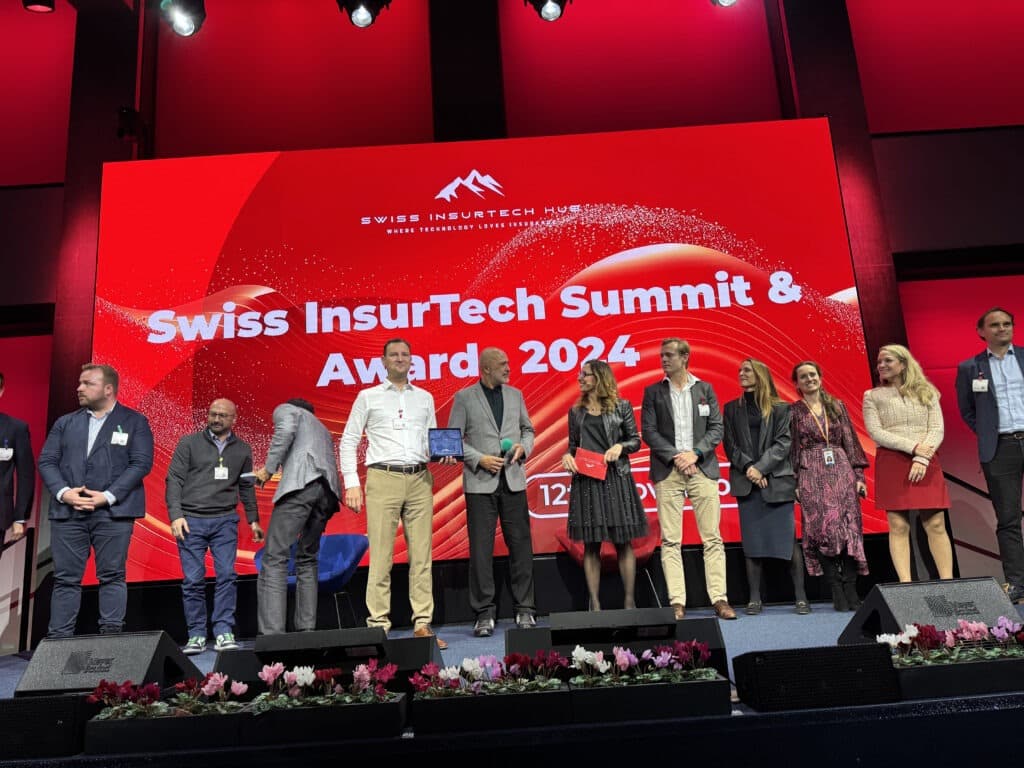

Outstanding achievements: Awards and recognitions

– Digital art: Exploris

– Convergence in decision-making: Ledgertech

– Life insurance solutions: s.360 life underwriting

– Excellence in claims processing: Quantev

– InsurTech of the year: Calvinrisk

Closing remarks and announcement of the date for next year’s InsurTech Hub Summit and awards event

Roger Peverelli, co-founder of ITC DIA Europe and chairman of the jury, emphasized responsible AI and the evolving potential of the insurance industry. The next summit has been scheduled for November 11th of the following year and promises to be another inspiring gathering of insurance innovators. Silvia Signoretti and Brijesh Luthra, President and Vice President of SIH, together with their team, were warmly applauded for organizing the remarkable event.

thebroker

Read also: Swiss Re Institute now offers a course for InsurTechs