Insurance is (finally) becoming interesting: here are three predictions for its future.

This article was originally published on finsurtech.ai where I share unfiltered insights into leadership, innovation and the future of the insurance industry.

I have spent my entire career in the insurance industry. It’s an industry that carries an enormous responsibility. Insurance serves to protect people from losses, risks and uncertainties.

But let’s be honest: for decades it seemed stagnant, boring and unfriendly. Every conversation revolved around the same topics: Risk management in complicated models, regulation, legacy systems and incremental change.

This era is coming to an end.

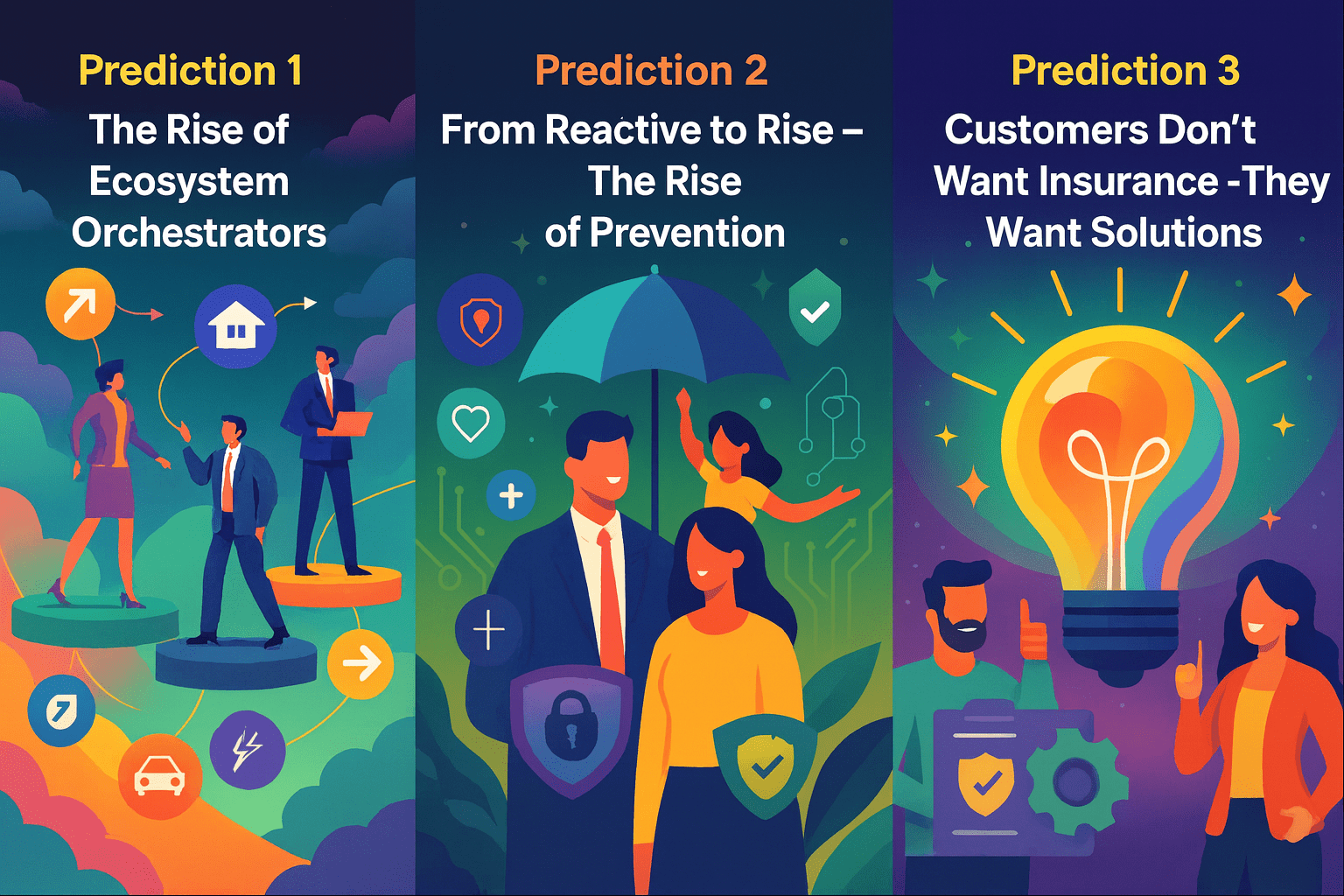

Today, the insurance industry is finally being redesigned. Not modernized, not more customer-centric, but fundamentally redefined. Below are three changes that I see happening and why they are more important than flashy apps or buzzwords.

Forecast 1: The rise of the ecosystem orchestrator

In der Vergangenheit kam Stärke aus dem Besitz. Besitz von Technologie, Besitz von Vertrieb, Besitz von Daten. Das moderne Modell ist das Gegenteil: Koordination statt Kontrolle.

Die Versicherer, die führend sein werden, sind diejenigen, die verstehen, wie man die richtigen Partner auswählt und aufeinander abstimmt, anstatt alles intern aufzubauen. Wir bewegen uns in Richtung einer ökosystemgetriebenen Wirtschaft, und Versicherungen bilden da keine Ausnahme.

This means you need to have a clear view of where your own capabilities end and where external partnerships offer real added value. Perhaps a startup has developed a claims processing function that is better than anything you’ve seen before. Should you replicate it internally? Copying isn’t cool, and maybe you can use your skills differently. Maybe it’s more lucrative for everyone involved to do research together and help the startup scale their solution.

It also means developing governance models that can deal with complexity without creating bottlenecks. Ten steering committees and dozens of approvals for the coffee brand changeover? That’s not enough when it comes to innovation and modern offerings.

Perhaps the most important thing is the humility to recognize that innovation often takes place outside your own four walls, and the openness to introduce this innovation without having to control it.

Hiring 300 developers abroad won’t get you there. However, building a flexible, composable architecture that lets you connect to insurtechs, MGAs and alternative data sources might.

The future is coming faster than we thought. The challenge is that most established companies still think in silos and procurement. Being an ecosystem orchestrator means changing the way you make decisions, not just who you work with.

Forecast 2: From reactive to proactive – the growth of prevention

We have been talking about prevention in this industry for some time, but nothing fundamental has changed yet. Seven years ago, we experimented with apps to detect traffic accidents and inform customers in good time. Today, any navigation software can do that.

In the past, the insurance industry has focused on what happens after an event. Only now are we starting to act

Prevention is more than motivational e-mails or downloadable PDF files.

Echtes Risikomanagement bedeutet, das Ereignis zu verhindern, nicht die Folgen zu bewältigen. Wir können beispielsweise IoT-Daten direkt in Preismodelle integrieren, sodass das Risiko kontinuierlich bewertet wird, nicht nur bei der Risikoprüfung. Oder wir können Kenntnisse aus der Verhaltenspsychologie nutzen, um Kunden dabei zu helfen, die richtigen Entscheidungen in Echtzeit zu treffen, nicht nur in der Theorie.

This is a change in the way insurers work, not just in the way they communicate. This requires new skills: Risk analysis, behavioral science and UX design. You don’t normally find that in underwriting departments, do you?

Aber es zahlt sich aus: weniger Schadensfälle, langfristige Beziehungen und Relevanz in einer Welt, in der Kunden mehr als nur eine Auszahlung erwarten.

And another thing: If your customer portal is still your most important “innovation”, you are probably lagging behind.

Forecast 3: Customers don’t want insurance – they want solutions

Ich war an einem Projekt zur Neugestaltung der SME-Journey beteiligt. Das Unternehmen war bereits einige Male daran gescheitert. Und das lag nicht an mangelnder Expertise, denn sie hatten das Risikowissen, die Technologie und die richtigen Leute im Team.

So why had it failed so often before? They had misunderstood the customer. They assumed that small business owners had the time and patience to deal with cyber risks, health insurance, property insurance or fleet management.

However, most of them were focused on completely different things: getting their business up and running, growing it and staying competitive. Insurance was not a priority, it was just another task to be done.

Dies ist ein systemisches Problem. Kunden, egal ob Privatpersonen oder Unternehmen, wollen keine Versicherung. Sie wollen Schutz, Stabilität und Unterstützung in Stresssituationen oder in Zeiten des Wandels.

We respond to this with PDF files, disclaimers and additional insurance.

What actually works? Insurance that is part of what people already do: a transaction, a booking, a service. No separate process, no search for insurance cover. A design that seems obvious, not clever. And business models that make things simpler, not more complicated. It’s as simple as that.

For insurers, this means moving from a product-oriented mindset to a design that is geared towards the customer journey. It also means moving away from the idea that insurance has to be a standalone purchase. Believe me, no one will miss a big insurance brand if they have an end-to-end solution to their problem.

Wohin führt das alles?

Insurance will not become a tech industry. But the companies that will be successful will act like orchestrators, behave like service providers and think like behavioral economists.

Those who cling to old models will not fail overnight. They will slowly lose relevance. The world is changing fast and small, smart companies are already entering the insurance value chain.

Now is the right time to make the right decisions. Not by copying Silicon Valley or chasing shiny trends, but by getting back to basics. Rethink how you enter into partnerships. Rethink how you manage risk. And above all, rethink how you present yourself to the people you claim to protect.

For once, the insurance industry is not boring. And I’m in.

Mirela Dimofte

Lesen Sie auch: Forget Your Job: AI Might Be After Your Security