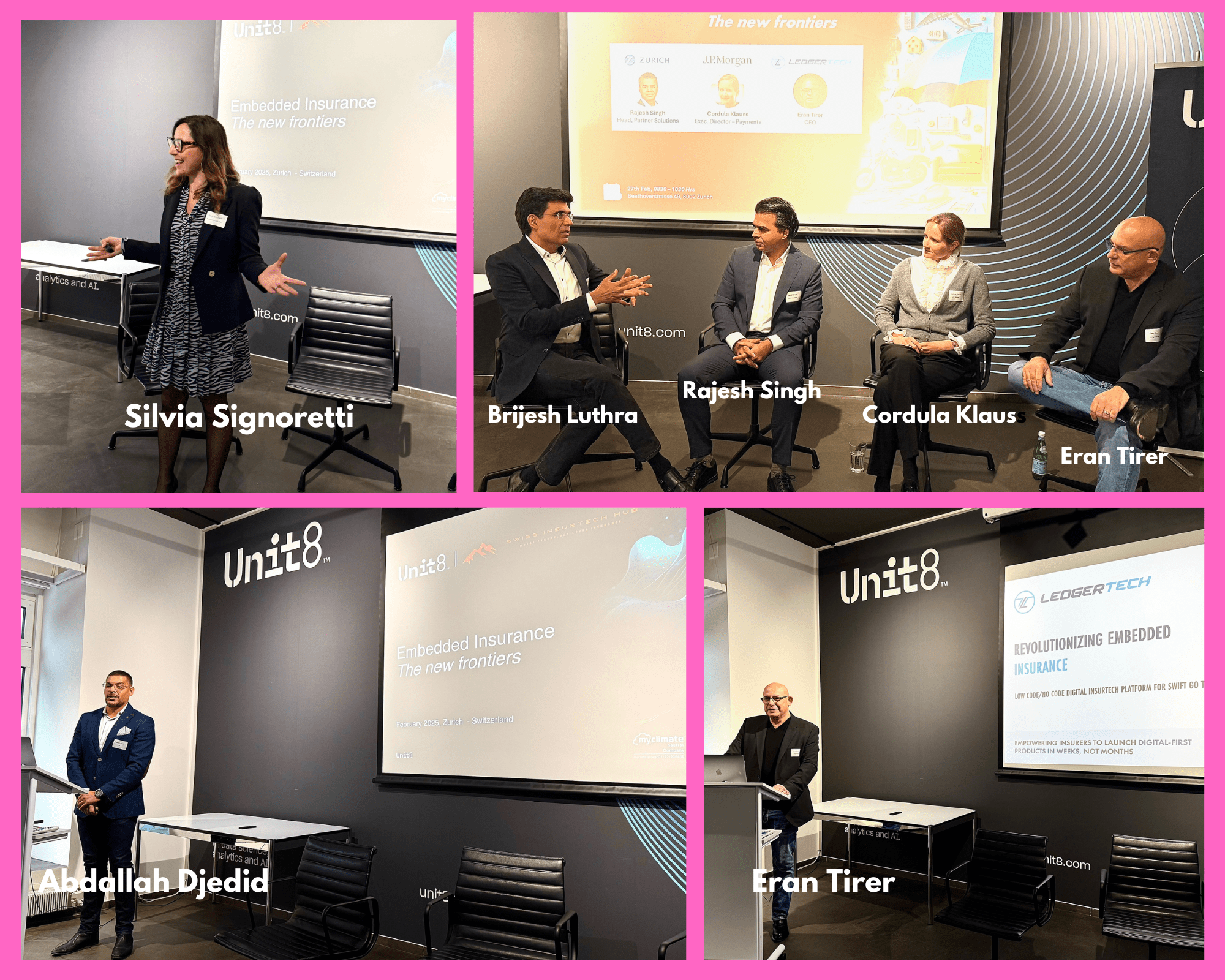

An event organised by the Swiss InsurTech Hub (SIH) once again made a big impression. At the AI company Unit8’s location in Zurich, attendees were welcomed by Abdallah Djedid. Cordula Klauss, Executive Director Payments at J.P. Morgan, Eran Tirer, CEO of Ledgertech and Rajesh Singh, Head Partner Solutions at Zurich, were invited to discuss the topic of “embedded insurance”.

They’ve done it again – last week, the Swiss InsurTech Hub (SIH), with Silvia Signoretti, President, supported by Vice Presidents Brijesh Luthra and Sharanjit Kaur, organised another exciting breakfast event at which industry leaders discussed how embedded insurance is reshaping financial services, payments and digital ecosystems.

The intersection of technology and insurance is not just a trend, but a transformative movement that is redefining the way companies operate and serve their customers. The introduction of embedded insurance – where insurance products are seamlessly integrated into the customer journey – has changed the rules of the game. In a discussion led by Brijesh Luthra, the nuances of this change and the role that artificial intelligence (AI) plays in shaping its future were explored by Cordula Klauss, Eran Tirer and Rajesh Singh.

The evolution of insurance

Insurance, traditionally seen as a complicated and often cumbersome process, has begun to change this outdated perception. In the past, taking out insurance meant lengthy meetings with agents, filling out forms and navigating a maze of jargon. However, as industry players adapt to the needs of the modern consumer, embedded insurance is coming to the fore, enabling customers to take out relevant insurance while engaging with various products and services.

This development goes back to early forms of insurance, when Chrysler bundled insurance with car purchases in the 1920s, or to the introduction of travel insurance at airports in the 1940s. What we are seeing now is an expansion of this concept, driven by technological advances and the relentless pursuit of convenience. Companies are beginning to realise that consumers are looking for a seamless experience – a way to ‘buy an experience’ rather than simply purchase a policy.

Using AI for smarter solutions

The application of AI in the insurance industry offers unprecedented opportunities. From automating claims processing to improving data management and providing real-time analytics, AI is the backbone that supports these innovations. Companies recognise the importance of a solid strategy – not only for implementing AI solutions, but also for creating an environment that promotes adaptability and efficiency.

There is a growing interest in AI solutions that process geospatial data to improve risk management and decision-making. By harnessing the power of AI, insurers can refine their approach to risk assessment, claim segmentation and overall customer service, turning data into actionable insights that promote proactive engagement.

Personalised experiences based on data

The future of the insurance industry depends on the ability to provide personalised, data-driven experiences. With the advent of AI, companies can develop tailored insurance products that meet the unique needs of consumers. By integrating customer data into every layer of service, from product design to customer interaction, companies can also improve customer retention and satisfaction rates.

This approach is not just about promoting products, but about understanding the consumer’s journey and addressing their individual issues. For example, insurers can use AI to analyse behavioural data and identify opportunities to create targeted campaigns that meet customer needs at critical moments, moving insurance from a reactive to a proactive measure.

The role of embedded insurance

Delving deeper into the realm of embedded insurance, we uncover a wealth of opportunity. Insurers that embrace this model are finding that they are able to meet the needs of a tech-savvy generation that desires convenience and flexibility. Customers today prefer to purchase insurance at the same time they make purchases, whether it is auto insurance when they buy a car or travel insurance when they buy a plane ticket.

The integration of insurance not only strengthens consumer trust, but also the relationships between brands and their customers. As a recent conversation between Abdallah Djedid and partners in the luxury goods industry revealed, companies are realising that offering insurance improves the customer experience and fosters loyalty. These firms are not just selling insurance, they are investing in the safety of their customers, which can be just as valuable – if not more so – than a direct revenue stream.

Embracing change to stay relevant

The insurance industry is on the cusp of a major transformation, similar to what has happened in other sectors. Just as companies have pivoted from making ice to producing refrigerators in the past, insurers must adapt to the dynamic landscape of digitalisation and embedded solutions.

In doing so, it is important to understand that digitalisation is not just an operational upgrade, but a cultural shift that requires agility for innovation while putting customer experience at the centre of decision-making. Insurers need to adapt their legacy systems to current needs and discard outdated practices in favour of optimised processes that take advantage of technology.

Not a fleeting trend

When we think about the future, it is clear that the integration of embedded insurance and AI is not a passing trend, but a fundamental change in the industry. Companies that seize this opportunity will not only improve their service offerings, but can also reposition themselves as leaders in a market that increasingly values immediacy, personalisation and seamless experiences.

While the growth potential of $700 billion was presented, one of the audience remained sceptical about the true customer value. He strongly believes that holistic advice from true experts remains the best and most convenient solution for individuals – not only with tailored recommendations, but also with continuous support.

At a crossroads

We are at a crossroads that requires ingenuity, collaboration and a strong focus on customer value. The road ahead is full of challenges, but the rewards for those willing to innovate are limitless. As the first panelists discuss their use cases and experiences in implementing embedded insurance, we look forward to witnessing how these changes will redefine the insurance landscape and usher in a new era of convenience and connectivity for customers everywhere.

Binci Heeb

Also read: Swiss InsurTech Hub (SIH): New Partnership with Groupe Mutuel