Embedded insurance is not only changing sales, but the logic of the entire industry. At the symposium at ETH Zurich, it became clear that insurance is becoming part of digital ecosystems and thus anchored in the value chain in a new way.

Embedded insurance is not just a new sales channel. Yuri Poletto, founder of the Open Embedded Insurance Observatory, spoke of an “invisible revolution” in his presentation. Insurance is no longer perceived as a separate product, but as a component of other services. This not only changes the customer experience, but also the entire value chain of the industry.

Four business models

Poletto distinguishes between four central business models. The best known is B2B2C. An insurer works together with a non-insurance-related partner, such as a bank, a retailer or a mobile phone provider. The insurance is integrated into their offering and sold jointly to end customers. This model has existed for decades in the form of affinity programs, but has gained enormous speed thanks to digital interfaces. New partnerships can now be set up in weeks rather than years because modular API architectures drastically reduce the technical effort involved. In Europe, this segment is growing around three times as fast as traditional insurance models.

The second model, B2B2B, is not aimed at consumers, but at small and medium-sized enterprises. Here, insurance is integrated directly into business software, such as accounting, payroll or logistics systems. When a company hires a new employee or writes an invoice, the appropriate insurance can be automatically suggested or adjusted. The big advantage lies in the data: it is generated in the system anyway and does not have to be laboriously collected. Insurance thus becomes a function within operational processes and loses its special status.

The third model is platform ecosystems. Major brands such as Tesla, Amazon and Revolut are developing into comprehensive service platforms in which insurance is just one component among many. These companies have highly detailed customer data, from driving behavior and purchase histories to usage habits. Extremely personalized insurance policies can be developed on this basis. In this model, the insurer becomes a technology and risk partner, providing capital, underwriting expertise and claims management, while the platform controls the customer experience. Insurance remains necessary, but loses control over the relationship with the customer.

Finally, the fourth model is the so-called enabler. These companies provide the technical infrastructure that connects insurers, platforms and sales partners. They translate between the fast-paced world of digital providers and the highly regulated, often cumbersome systems of insurers. Their role is comparable to that of payment service providers such as Stripe in e-commerce. Without enablers, many embedded insurance models would hardly be feasible because the technical complexity would be too high. With them, the time-to-market drops from up to 18 months to less than two months in some cases.

Technology as a driver

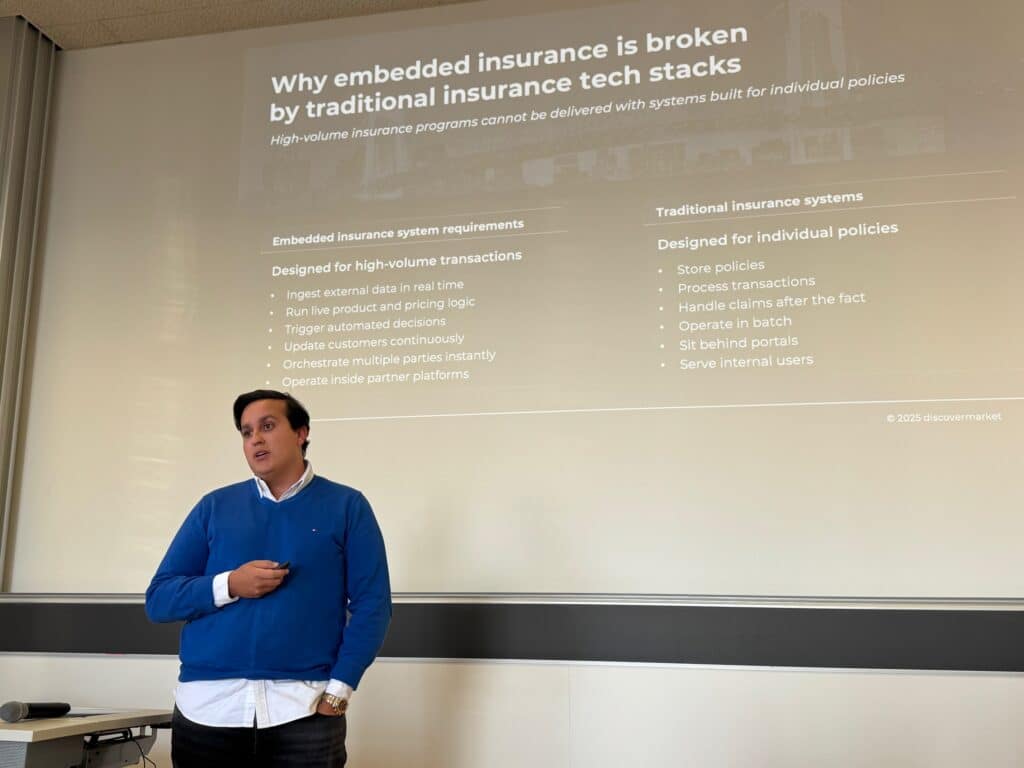

These new models are changing the technological basis of the industry. Traditional policy management systems, often decades old, are reaching their limits. Eran Tirer, CEO of Ledgertech, described how many insurers are still working with mainframe or COBOL systems that are hardly suitable for flexible, context-based products. At the same time, the use of AI is forcing companies to think in terms of cloud infrastructures, as computationally intensive models can hardly be operated on-premise. Embedded insurance is therefore becoming a driver of comprehensive IT modernization.

Artificial intelligence also plays a central role. It is used in underwriting, claims processing, customer communication and even in the simplification of insurance terms and conditions. Some providers are already using AI to create comprehensible summaries from 30-page general terms and conditions. This is intended to create transparency in a world where insurance is becoming increasingly invisible. Because this is precisely where one of the greatest dangers lies: If customers no longer realize that they are taking out insurance, trust suffers.

New economy

Economically, embedded insurance is attractive for many. Studies presented at the symposium show that integrated insurance cover can increase the probability of a product being concluded by up to 60 percent. This means higher conversion for platforms and potentially lower acquisition costs for insurers. However, this effect is not guaranteed. If insurance is poorly integrated or does not offer clear added value, it will simply be ignored or perceived as a nuisance.

Strategy and culture

Strategically, all parties involved face major challenges. “Embedded insurance requires close coordination between the insurer, platform and technology partner. If one of these players does not cooperate, the entire customer journey suffers. There is also a cultural conflict: tech companies work iteratively, quickly and experimentally, while insurers are cautious, regulation-heavy and risk-averse. Successful companies are those that consciously bring these two worlds together and do not play them off against each other.

Agentic AI and the cultural shift

Sabine van der Linden, CEO of Alchemy Crew Ventures, who has been working at the interface between insurance, innovation and start-ups for decades, provided a further strategic perspective. Her presentation on “Agentic AI” was less about individual tools and more about a fundamental change in roles. According to van der Linden, artificial intelligence will not only provide support in the future, but will also act independently, prioritize and prepare decisions. Insurers will have to adapt to the fact that processes will no longer just be automated, but controlled autonomously to some extent.

She made it clear that the biggest hurdle was not technological, but cultural. Many insurance companies are structurally designed to minimize risks, while digital ecosystems focus on speed, experimentation and learning from mistakes. Embedded insurance exacerbates this conflict because insurers are suddenly part of platforms that tick very differently to traditional organizations. If you want to survive here, you have to learn to relinquish control without losing responsibility.

Van der Linden linked this topic directly to embedded insurance. If insurance becomes invisible, the logic behind it needs to be all the more transparent. Agentic AI could help to make complex decisions understandable, constantly reassess risks and provide customers with situational support. At the same time, she warned against seeing technology as an end in itself. The decisive factor is not how intelligent a system is, but whether it builds trust. In a world in which insurance is no longer perceived as a separate step, trust is becoming the real currency of the industry.

Insurance no longer the focus

The conclusion of the symposium was clear. “Embedded insurance” is not an addition to the existing business, but a structural change. Insurance is becoming an infrastructure, comparable to payment systems or identity services. The winners of this development will not necessarily be those who have the best product, but those who can best orchestrate complex ecosystems. In this new logic, insurance is no longer the focal point, but part of a larger whole, and this is precisely where its future lies.

Binci Heeb

Read also: Embedded insurance in everyday life